A mentality for approaching dual-use venture investment

Fundraising should be viewed as a means rather than an end. I wrote about this in general terms in the prior article and expand on this concept below.

Fundraising and investing are two sides of the same transaction. Such transactions are highly dependent on human networks, and trends, marketing, and hype influence humans tremendously. For example, VCs will especially scrutinize avant-garde battery technologies because venture investment in such startups proved to be hugely expensive and under-performant bets over the past decade. While this adds investment headwind with which a battery startup must contend, the startups that ultimately receive investment will have successfully navigated a high threshold that experienced VCs will have developed as a learned response or wariness, and thus the investment community overall exercises greater discernment with their investments in this space. The aforementioned example is one way the venture capital industry can learn from the past and apply to the present.

Founder beware: there is tricky terrain ahead

Aspiring defense-serving, VC-raising founders beware: you are treading into two industries that are both renowned for being opaque, tight-lipped, and relationship-driven.

A DuV founder is facing the union of a set of challenges that come from working in either the venture capital industry or the defense industry. To up the ante, pursuing the DuV path means founding teams are likely to face both simultaneously.

Any dual-use startup founder must have, or cultivate, ‘ins’. Said founder must find allies who have extensive networks. In my observations, defense-related social networks are elusive to most technology founders and this is likely an experience shared by tech entrepreneurs emerging from other major research institutions like MIT.

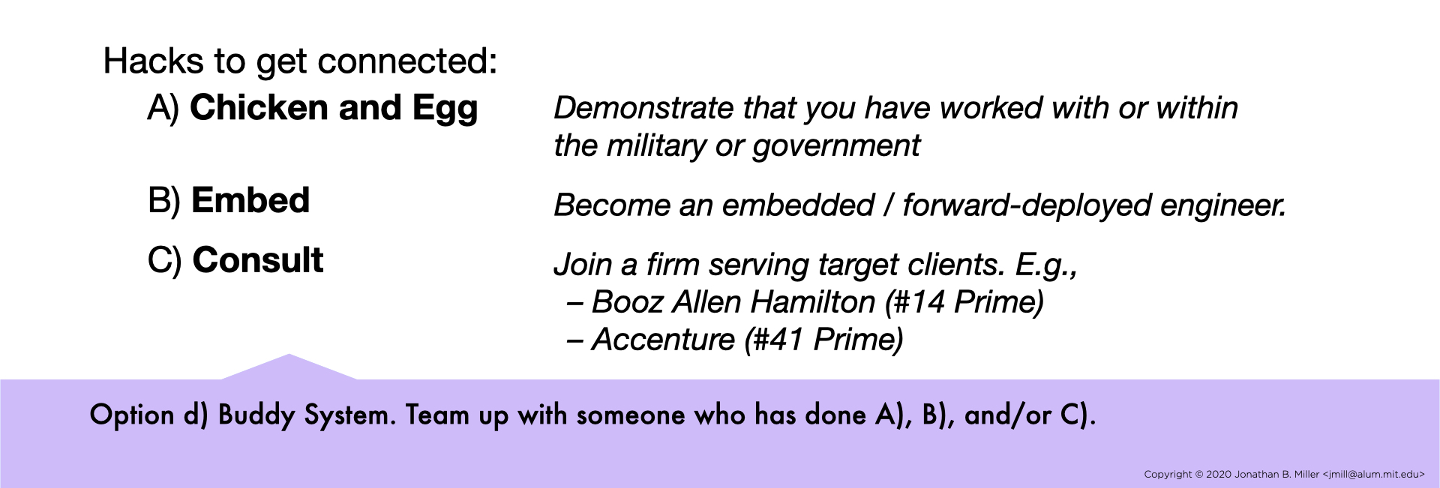

Based on my observations, here are several hacks for a founder to get connected to defense:

A) 🐣 Chicken and Egg: Demonstrate that you have worked with military or government representatives previously.

B) 🌍 Embed: Become an embedded or forward-deployed engineer.

C) 👔 Consult: Not excited about engineering? Join a consulting company serving governmental clients.

And one Bonus 🎁 hack:

D) 🤝 Buddy System: Team up with someone who has done A), B), and/or C).

These are several “hacks”, or approaches, to gaining broader exposure to, and rapport with, members of government social networks.

Each ‘hack’ is elaborated below:

- 🐣 Chicken and Egg involves exhibiting affiliation with (and empathy for) relevant dual-use problem sets. There is a positive reinforcement loop that can be nurtured to show that one has understanding of dual-use problem sets, leading to stronger professional connections with colleagues working in adjacent areas, which can enable further refinement on the documented and latent needs within the problem set and empathy for the stakeholders. For tough tech founders, scientists, and engineers who envision a dual-use application for their work though may not have preëxisting government or military affiliation, a means to kickstart the reinforcement loop is to request ‘curiosity calls’ with individuals who may be currently or formerly working on or adjacent to a problem area of mutual interest within a government or military context. Note that a sales pitch is toxic and much care must be taken to avoid putting the interviewee in an uncomfortable (or even illegal) position of confidentiality. A DuV entrepreneur-researcher who is well-prepared, knowledgeable, and inquisitive in conducting informal interviews can learn much about emerging problem areas without delving into specifics, to discover new colleagues who may also be interested in the space, and, hopefully, to also leave his or her interviewees feeling like they, too, got smarter from the conversations.

- 🌍 Embed is an all-in tactic. Consider joining a firm that supports embedding, such as Palantir. A forward-deployed engineer works closely with one of the host company’s clients, such as a government agency. A founder of a DuV valued at approximately one hundred million dollars told me his forward-deployed experience in Afghanistan was instrumental since, years later, he could draw on and market that first-hand experience as he built his company.

- 👔 Consult is a softer flavor of Embed. There are companies who specialize in government and government-adjacent consulting. Prime examples (pun intended) include Booz Allen Hamilton (#14 on the list of top prime contractors), Accenture (#41), and Deloitte (#45).

- 🤝 Buddy System underlies all of the above approaches. In a reputation- and trust- based ecosystem like venture capital and defense, we may be evaluated more stringently by the company we keep. Effectively co-founding a startup is akin to a form of marriage, so with whom one chooses to go into business is tantamount, and an outward projection of some part of ourselves, our values, and our character.

These are four tactics I have observed over the course of my research effectively applied by successful DuV founders. There are some programs across the United States that provide support for startup teams to identify potential customers within the government. For example, at MIT, in 2020 we launched a DuV-oriented program for MIT-affiliated members who are building tough tech companies.

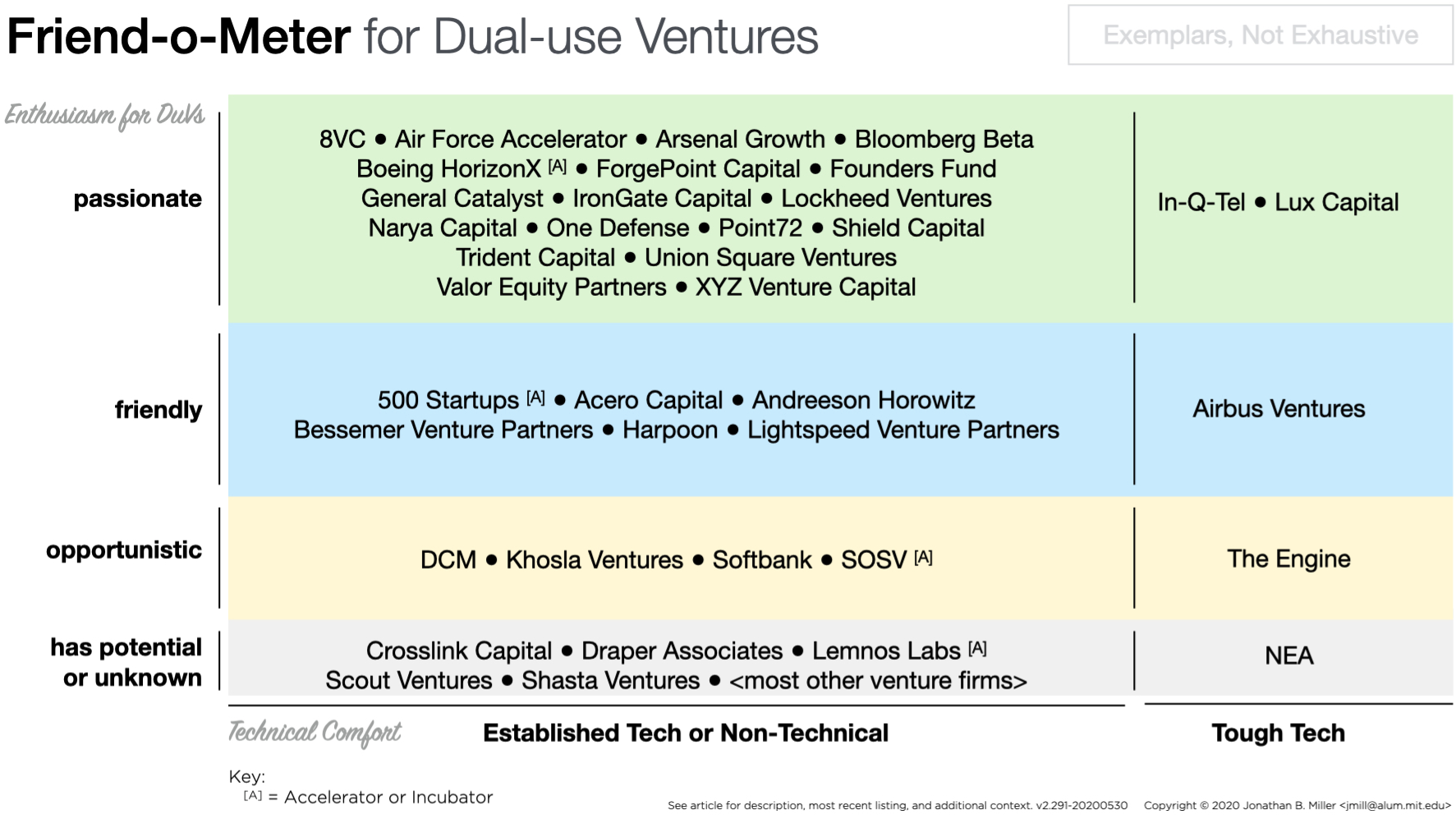

Introducing the “Friend-o-Meter”

There are varying degrees of support among Venture Capital firms and their willingness to invest in DuVs.

After interviewing hundreds of folks, including venture capitalists, government representatives, and successful dual-use entrepreneurs, I developed a tool for organizing venture capital firms along two key dimensions:

- Enthusiasm for dual-use opportunities. Ratings: Passionate, Friendly, Opportunistic, Has potential or unknown.

- Comfort with tough technologies. Ratings: Tough Tech, Established Tech, Non-Technical

As a first-pass at organizing this landscape, presented below is the Friend-o-Meter.

The Friend-o-Meter provides a glimpse into the firms which have demonstrated interest in supporting the two tenants of dual-use ventures: 1) Enthusiasm for dual-use opportunities and 2) Comfort with tough technologies.

The DuV Friend-o-Meter is clearly not exhaustive. However, it is indicative of the health of the investment community and, thus, a sense of the magnitude of impact possible with the two ROIs: return on investment and return on innovation. (To read more on this, please refer back to an earlier piece in this series, Part 2: Investor Motivations.) Note that the list of firms designated as “passionate” is denser than the other sections – this is intentional, to be most useful to the dual-use entrepreneur. If we were to list all known venture firms, the majority would be placed in the “has potential or unknown” designation, greatly distorting the scale depicted here.

For Enthusiasm for dual-use opportunities, this is qualitatively organized from high to low, top to bottom.

- “Passionate” indicates that at least two investors in the firm, if not the whole firm, invest almost entirely in DuVs.

- “Friendly” indicates that there is at least one investor, or the full-time-equivalent among a team of investors, who views government contracting as a source of revenue that complements a venture’s commercial objectives. Such investors may themselves have past experience in leadership roles investing into, operating, or otherwise supporting DuVs, and know how to navigate the varied phases of SBIRs and STTRs.

- The “Opportunistic” designation is applied to firms who may occasionally support a DuV, though it is absolutely not part of their main investment thesis.

- Finally, the “Has potential or unknown” designation is where the majority of investment firms occupy (despite how it is not drawn to scale in the accompanying graphic). Such investors may be wary of investing into a startup which has a member of the DoD on its client list, and this may be due to: a) lack of experience in government contracting; b) concerns over branding or marketing; c) perceiving government contracts as non-recurring revenue; d) viewing contracts as distractions from a startup’s strategic plan; or e) combinations of the above and other rationale. While some such investment firms may be discounted completely, plenty are not aware or haven’t yet been exposed to an attractive DuV opportunity, so a little education may go a long way to gain support from investors within the “Unknown or has potential” designation.

For Comfort with tough technologies, this is a scale with two buckets.

- “Established Tech or Non-Technical” is a broad label that includes firms and programs that tend to work with technologies that are somewhat established. The commercial-technical fields they utilize or serve may be looked up in market research reports and a reasonable estimate of technical rick can be formulated.

- “Tough Tech” is a designation for the venture capital providers who invest in companies commercializing frontier technologies. Tough technologies have advantages and application areas that may serve multiple nascent fields, though specific benefits and markets may remain vague (or unsubstantiated by customer revenue) for some time.

The Comfort with tough technologies scale is intended to designate firms which are suited for longer investment horizons. Many firms are structured to seek a “liquidation event” such as a financial acquisition or I.P.O. within a few years of investment into a startup. “Tough tech” investors understand that plenty of transformative technologies, particularly lab-to-market plays, often necessitate a longer investment horizon, sometimes measured on the order of five to fifteen years, and thus structure their teams, funds, and Limited Partners’ expectations to better cultivate deeply technical expertise, with a corresponding aim for outsized ROIs and industry transformations. Technical-leaning firms may support portfolio companies with in-house engineers, add technical partners or a Chief Technology Officer, and other structural variants to align the firm with the unique qualities of tough tech startup investment sourcing, diligence, and growth.

Future work to extend this analysis may include quantitative delineation among these ratings, such as based on the percentage of portfolio allocated to DuVs as measured by $USD invested or market capitalization. A firm’s role in leading or co-leading investment into tough tech, traditional tech, etc., may also be helpful for stratifying the Friend-o-Meter.

A maintained version of the Friend-o-Meter will be available here for some time:

- Kanban view: https://airtable.com/shrzkzGkTAbUUdf1U/tbltiVURkGgDxLiXp

- Spreadsheet view: https://airtable.com/shrDxgWIhw02yw9Im

Do you know of a venture investment firm that should be on the DuV Friend-o-Meter? Additional firms can be suggested by contacting us. For any firm suggested, please list DuV startup(s) invested in, thought leadership in the space, and other indicators of support for DuVs, such as evidence of CFIUS/FIRRMA compliance. █

This post is part of the Who’s Your Ally series, by Jonathan B. Miller, an MIT Innovation Initiative research affiliate.

Copyright © 2020 Jonathan B. Miller <jmill@alum.mit.edu>