US President Eisenhower during his 1961 address warning of the growth of the military industrial complex. Bill Allen/AP

In 1961, President Dwight D. Eisenhower issued a stern warning about the growth of the “military-industrial complex”.

The First Era, largely defined by government reliance on civilian industry only while the nation was at war, had been the modus operandi until the onset of World War II. The Second Era of the military-industrial complex thus began, in which defense contractors proliferated. As a reference point, United States arms production exploded from one percent of annual Gross Domestic Product (GDP) in the early 1900s to forty percent of U.S. GDP in the 1940s, as written in William Lynn III’s article “The End of the Military-Industrial Complex”. From World War II through the Cold War, there were substantial innovations (with many civilian benefits) developed by a multitude of defense contractors. As an arguably ‘architected’ result, the American domestic economy became tied to the success of its defense industry, and thus overwhelmingly to the interests of the prime contractors that I describe later in the article.

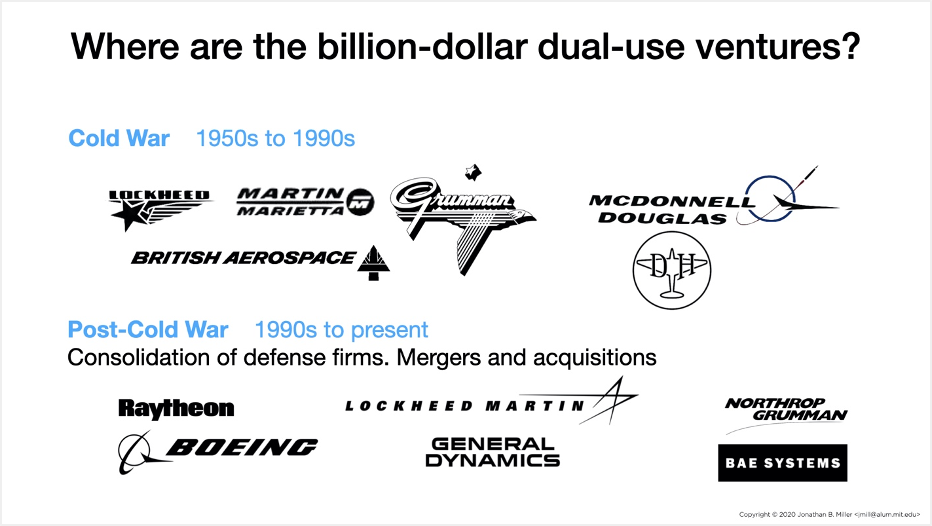

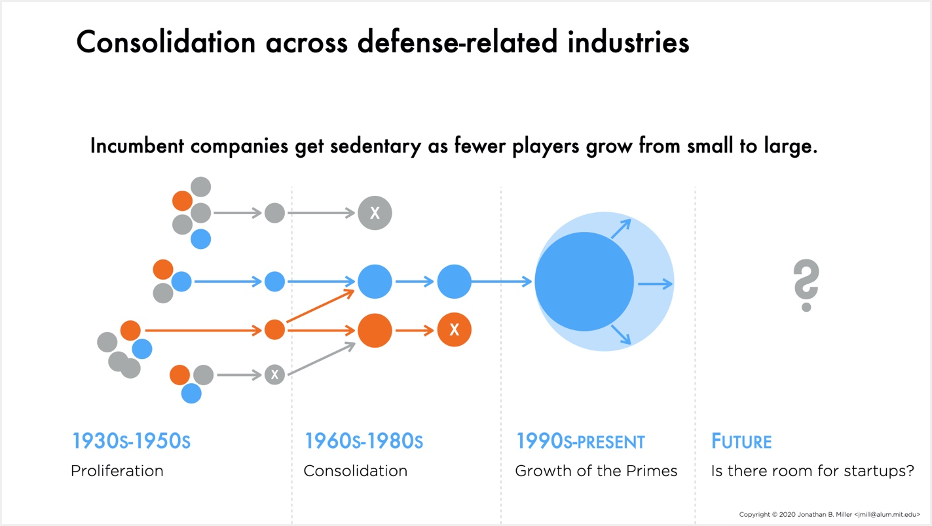

The Cold War era led to the growth and maturation of many defense-serving companies, which then, through a barrage of mergers and acquisitions, consolidated to our present-state mega primes.

Following the collapse of the Soviet Union and, symbolically, the end of the Cold War, the United States and its defense contractors entered the Third Era. Massive consolidation of contractors, and a shift to focusing on civilian pursuits, counter-intuitively bred a sedentary period. Large firms, somewhat lethargic without existential threats to the nation or – nearly as important in some folks’ views – to the firms’ themselves, continued building a federal contracting system that oft favored incumbent players. The causes of the imbalance may be predominantly attributed to two emergent factors: 1) lobbying and 2) precedence.

The consolidation across defense-related industries in the United States over the past century could be marked by periods of proliferation in the 1930s-1950s, consolidation from the 1960s-1980s, and growth of the primes since the 1990s. Future contracting enablement could create more space for younger companies to become large firms.

In the early 2000s, with a maturing Internet, the transformative effects of the Information Age propagating globally, and repercussions of tragic events occurring on September 11, 2001, a slow shift in the (im)balance of power commenced. Small, nimble ventures were building sophisticated software and hardware systems that outperformed what the United States federal government could acquire from its familiar, established defense contractor community. Similarly, the DoD recognized its eroding technical advantage against current and anticipated adversaries and developed the “Third Offset Strategy”, which prioritizes investment and adoption of tough technologies including autonomous systems, robotics, miniaturization, and advanced manufacturing.

The DoD’s generous application of the word “innovation” peaked around the mid 2010’s with the rebranding of defense contractors from “private industry” to the “National Security Innovation Base”. Some attribute this era of ‘innovation’ within the DoD to Secretary of Defense Ash Carter who established the Defense Innovation Unit Experimental and the Defense Innovation Board. Instantiations and sister programs have emerged, to varying levels of success. One of the most successful, the Air Force Innovation Hub Network (AFWERX), coalesced in late 2017 within the United States Air Force, functioning like a philosophical spark plug to a new way of federal acquisition regulation interpretation and engagement with startups. Other examples include:

- accelerators like MassChallenge’s Safety and Security cohorts and the Techstar’s Air Force Accelerator,

- technology demonstration organizations such as NavalX Agility and the Army’s xTechSearch,

- regional lab-space collaborations including the Army Research Lab Open Campus initiative,

- DoD-funded challenges hosted by the non-profit SOFWERX organization in support of US Special Operations Command (SOCOM), and

- liaison-style offices outside of Washington, D.C., such as the DIU and Navy Tech Bridge sites.

The above initiatives represent several of a myriad of programs belonging to multiple branches of the DoD. For an experienced DuV founder, it’s complicated; for an aspiring DuV entrepreneur, it can be downright off-putting.

One of the drivers of the above initiatives is the imperative for earlier identification and hastened onboarding of new, externally-developed technologies within the DoD. With the ‘clean slate’ formation of the US Space Force, there is an opportunity for quicker acquisition authority. For example, the force is building a software development program that is modeled after the Air Force’s Kessel Run, though this has less to do with external contracting of startups and more with internal capabilities enhancement. If Space Force succeeds in establishing a risk-tolerant, expediency-conscious culture as General Jay Raymond told the House Armed Services Committee, then this disposition favors technical startups. However, if such virtues remain largely verbal promises, rather than authoritative or financial commitments, then an acquisition process favoring incumbents will remain.

The main takeaways of these developments in defense contracting are that startups must – and, in some cases, do – benefit from reinterpretations of existing contracting laws for:

a) Expedited contracting

b) Shielding from direct competition with incumbent primes, as some RFPs (Requests for Proposals) are strictly for small entities via set-aside procurements

c) Stronger, less opaque pathways to engage with members of the DoD community, with the US Air Force demonstrating the strongest leadership to-date.

“The Government” and “The Primes”

“The Government” is a convenient, monolithic, and misleading view of the United States federal government, which can be decomposed into hundreds of organizations and thousands of departments employing millions of citizens. It is a massive system-of-systems, with different cultures, contracting implementations, and purchasing processes. Tough tech startups should approach with the mentality that there is probably much less interaction between and across agencies and departments than one would expect. As a vast organization, most parts of “the Government” aren’t fully aware of what the other parts are doing because of the division of labor.

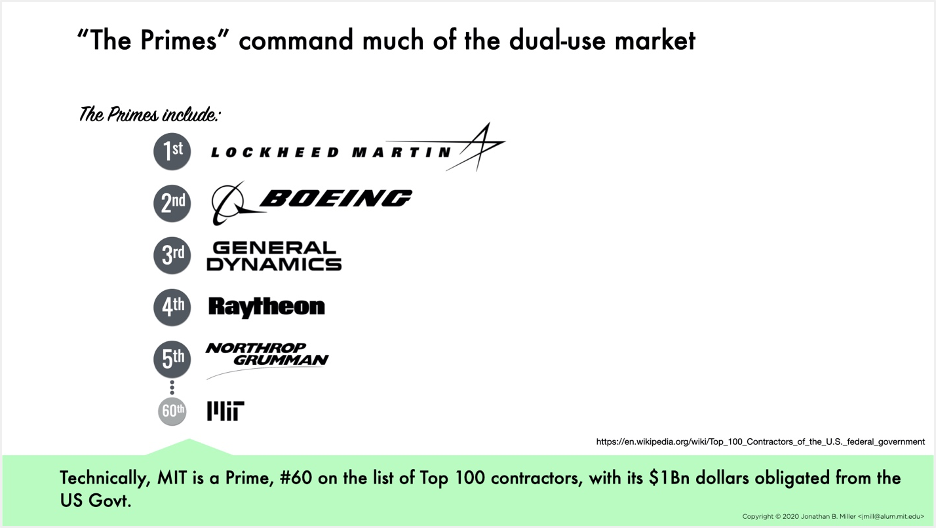

The Primes, or the top contractors of the US Federal Government, include:

- Lockheed Martin

- Boeing

- General Dynamics

- Raytheon

- Northrop Grumman

The top five United States prime contractors are Lockheed Martin, Boeing, General Dynamics, Raytheon, and Northrop Grumman. For a sense of scale, I have noted MIT’s location as the #60 prime contractor, which is largely allocated to the Lincoln Laboratory, with its $1Bn USD obligated from the US federal government. However, when people refer to “The Primes”, it’s usually the top five to ten contractors, who account for twenty to thirty percent of federal dollar obligations.

Prime contracting and the influence primes can exert on the market existed prior to World War II. For example, Mark Wilson writes in The Business of Civil War’s chapter “The Trouble with Contracting” that in the United States between 1861 and 1865, many small farmers complained that, due to the wartime Union government asking for large lots of horses (on the scale of five thousand horses per order), the majority of farmers were effectively cut out from serving the war effort, though there were thousands of farmers who could feasibly provide twenty or thirty horses per farm, and thus tens of thousands of horses in aggregate.

Prime Survival

Ventures must be careful when working with the primes. Prime contractors will limit the growth of a startup as a natural survival mechanism, to exert control over potentially disruptive upstarts who may be thus limited in their abilities to subcontract with other primes or contract directly with the US government. Such means of influence may include invitations to participate in prime-hosted startup accelerators, incubators, subcontracting opportunities, and proof-of-concept demonstrations that tend to provide only short-term gains to a young venture, while primes benefit from using their name and resources to:

- a) identify breakout teams and their technologies,

- b) learn from and capitalize on access to those teams/technologies, and

- c) maintain or strengthen the military-industrial ecosystem that favors the incumbents.

This is not to be misconstrued as “bad” or “good”, but rather it is an emergent yet unsurprising behavior that Eisenhower et al foretold long ago. The national security innovation base has developed contract vehicles, marketing, and, perhaps most importantly, a sense of recognition that the frontier technology du jour may be housed not within a prime contractor’s skunkworks as was likely in the past, but rather literally within an entrepreneur’s house.

In the next post, I describe the environment in which any startup founder today must navigate.

This post is part of the Who’s Your Ally series, by Jonathan B. Miller, an MIT Innovation Initiative research affiliate.

Copyright © 2020 Jonathan B. Miller <jmill@alum.mit.edu>