Read the Who’s Your Ally introduction here.

In the early 1900s, after successfully demonstrating their powered flying machine, the Wright Brothers tried selling their flyer design to the US Government. The feds, however, did not know what to do with it, so the Wright Brothers reluctantly approached European governments and found a receptive audience and a new customer base. Why were the Europeans willing to adopt this new technology while the Americans were dismissive? In brief, the Europeans had cognitive precedent for experimental flying machines based on popular stories of gliders and balloonists who were challenging humanity’s traditional confines of two feet firmly planted on Earth. For more on this, read David McCullough’s The Wright Brothers.

Anyone can posit what is the modern equivalent of the Wright Brothers disruptive ‘flying machine’ that our governments should be supporting. Artificial intelligence, energy generation and storage, and synthetic biology are all massive fields with captivating – and terrifying – potential for civilian and defense applications.

It’s not just about Airplanes… or Guns

In Part 0, tough-tech dual-use ventures (DuVs) were described. DuVs are expanding frontiers in almost any industry, including, but not limited to, Enterprise Software, Analytics, Internet of Things, Robotics, Biotech, Energy, and other tough tech specialties that could be wildly successful in transforming industries and worldviews.

The US government is slow to buy… and slow to stop buying

There is an assumption among the business community that the US government is slow to buy… and slow to stop buying. The steep front-loaded challenges of securing a lucrative government contract of the Phase III or post-Phase III SBIR/STTR (“Small Business Innovation Research” and “Small Business Technology Transfer”) variety can be, in hindsight, a terrible waste of effort or a valuable opportunity. An example of the former is the statement I received from an investor: “Just sell to commercial markets because you’ll learn faster.” For the latter, plenty of entrepreneurs with whom I have spoken have relayed to me the surprise they experienced when they saw just how many non-dilutive federal funds were available. While most venture investors perceive a startup’s government funding as non-recurring revenue, it is revenue nonetheless, though best complemented by strong commercial interest.

The Innovation Ecosystem Stakeholder Model and Benefits of DuVs

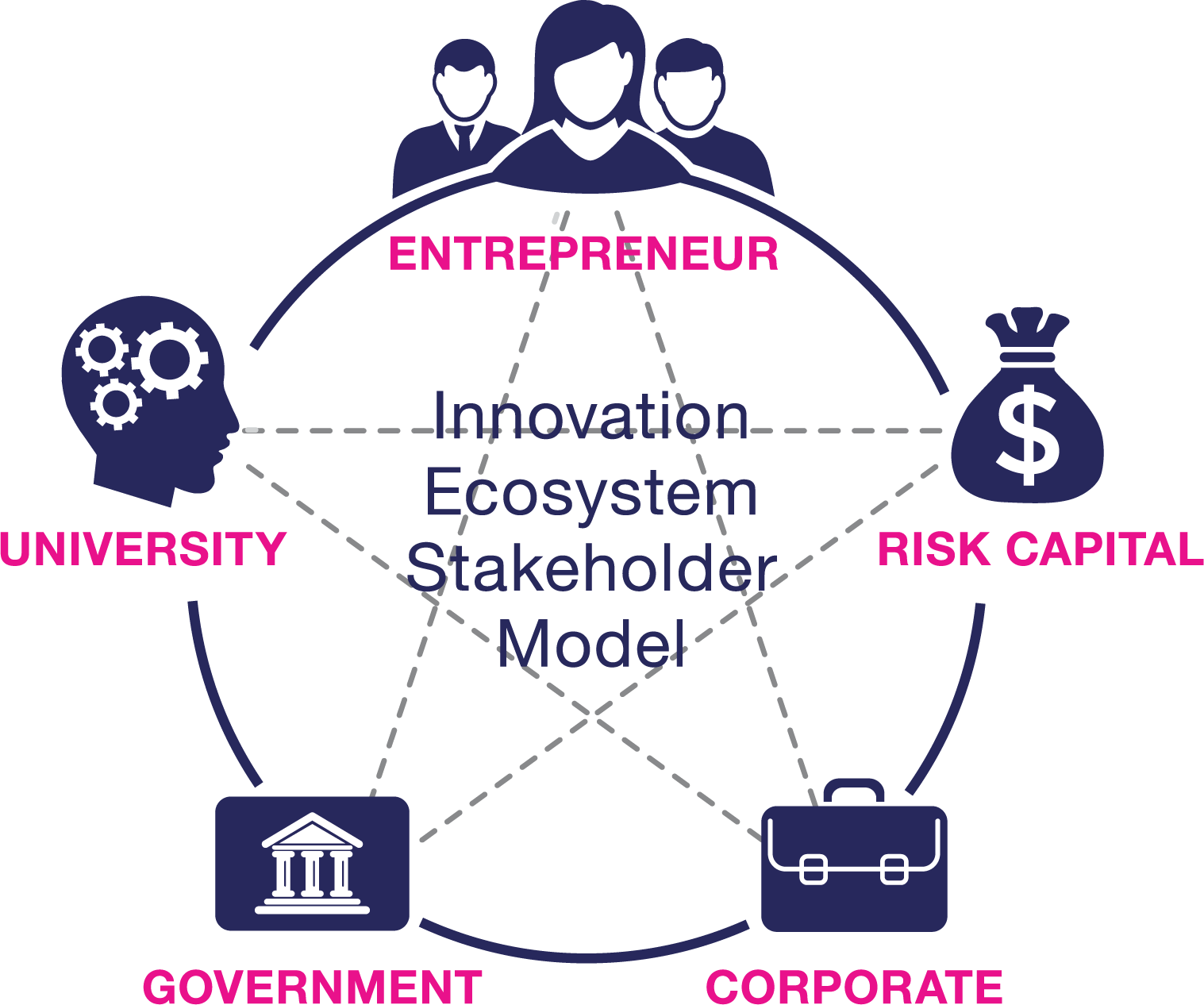

Governments, entrepreneurs, investors, academics, and corporations must collaborate to successfully foster deeply technical startups that can mutually benefit the commercial and government sectors. The Innovation Ecosystem Stakeholder Model developed by Prof. Fiona Murray of MIT depicts these relationships.

The five stakeholders of the Innovation Ecosystem include entrepreneurs, risk capital (venture capital), corporates, governments, and universities. Model by Prof. Fiona Murray et al of MIT.

To summarize several of the reasons why venture investors are interested in DuVs:

- Strong and consistent demand signal: As mentioned previously, although the government is slow to buy, it is slow to stop buying, and revolutions aside, there will always be “a government”.

- Preservation of control: Federal funding is non-dilutive capital, so a startup’s equity pie need not get sliced too thin or too early.

- De-risking: A startup that is able to generate revenue from sufficiently distinct customer segments like governments and the private sector has risk differentiation. For example, the US government is less sensitive to market fluctuations than the private sector. Alternatively, government agencies are impacted by political regime changes, while the private sector is fast-moving though always influenced by the national economy.

In the following post in the series, I will describe observations and guidelines so tough tech founders can understand investors’ motivations. █

This post is part of the Who’s Your Ally series, by Jonathan B. Miller, an MIT Innovation Initiative research affiliate.

Copyright © 2020 Jonathan B. Miller <jmill@alum.mit.edu>