The following is an overview of how a technology startup can identify the venture capital investors that best suits its market(s). Entrepreneurs who seek venture capital can improve their negotiating position when they understand investor motivations. In the preceding Part 0 of this series, I define dual-use ventures (DuVs) and venture capital investors (VCs). In Part 1, I show the Innovation Ecosystem Stakeholder Model, which includes Risk Capital as one of the five stakeholders.

The two ROIs: Return on Investment and Return on Innovation

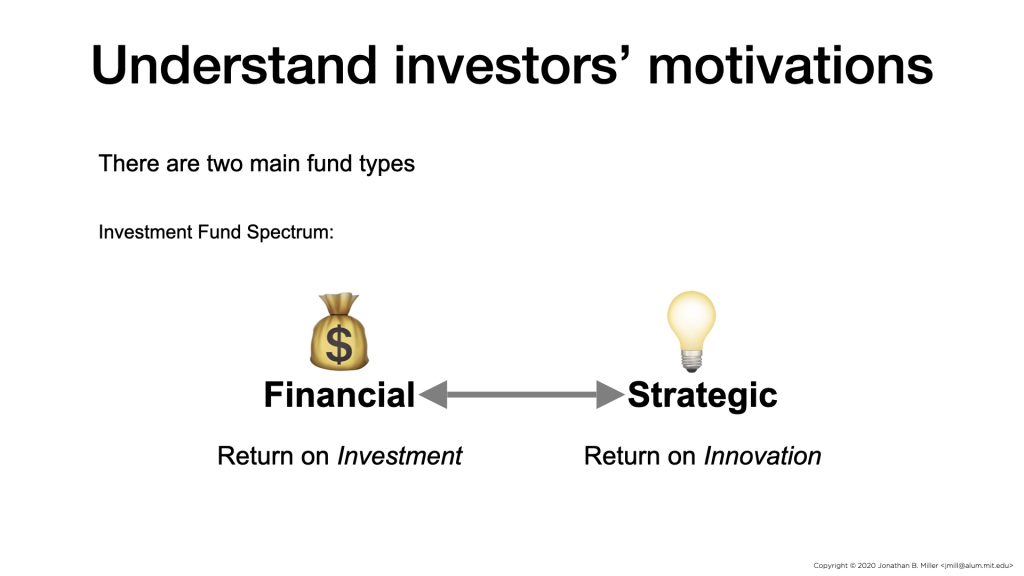

On the spectrum of venture funds, there are two ends: the finance-minded and the strategy-minded.

Two ends of the venture investment spectrum: Financial and Strategic

Pure financially-motivated investors pursue a return on investment (“ROI”). This is measured in common trading currency, such as $USD, €EUR, ¥JPY, or £GBP.

Pure strategically-motivated investors pursue a return on innovation (“the other ROI”). Venture capital investors measure innovation in a variety of ways, none of which are particularly accurate for capturing the underlying drivers. For example, “innovation” is sometimes measured as number and quality of patents filed and awarded, technology trends detected or accessed, mergers and acquisitions (“M&A”) pipeline, businesses launched in new markets, commercial relationships developed, branded opportunities, talent recruited, and other trackable parameters. Innovation metrics adopted by investors are often based on some of the thought leaders in this space, such as:

A. academic research institutions like MIT, which publish papers and articles

B. non-profit research and development organizations like SRI International, corporate skunkworks like Alphabet X,

C. consulting giants including McKinsey & Co., and

D. venture accelerators like 500 Startups.

Most investors are somewhere along the spectrum of financial and strategic motivations, favoring one ROI over the other ROI, or perhaps striving for both.

There are VCs, there are CVCs, and then there’s In-Q-Tel

While all investment funds could be plotted somewhere along the ROI spectrum, the venture capital funds themselves differ in capital structure, management methodology, and market expertise.

Traditional venture capital (VC) funds tend to be financially-oriented with a target return on investment of approximately twenty percent capital growth per year for five years. This means that investors are hoping for any particular startup in the fund’s portfolio to generate 10x returns to help cover the losses from all the other portfolio startups that fizzle out. Venture investment funds target returns as soon as three years from investment, although some patient funds may be willing to wait a decade or greater, particularly for early stage ‘tough tech’ lab-to-market investments. Ultimately, traditional VCs are looking for a business that will generate an ROI, inherent to which is the startup’s willingness to shift markets or play into emerging markets.

Some corporate entities opt to sponsor their own venture investment arm. These firms, called Corporate Venture Capital (CVC) funds, tend to balance financial and strategic investments, or may pursue pure strategic investments. The managers of a given CVC fund may be under an explicit or implicit charge to identify synergies within the parent corporation. Thus, CVCs are often not strictly financial returns-driven.

In 2019, the US Department of Defense launched the Trusted Capital Marketplace with a goal to connect startups pursuing private funding and vetted venture investors who are ready to fund such startups. Created to counter the risk of intellectual property theft by particular nations, chiefly China and Russia, the Trusted Capital Marketplace of defense-friendly investors is nascent, though there are informal networks of such investors already.

In-Q-Tel, a special not-for-profit venture capital firm, constitutes a third VC ‘class’ relevant to DuVs. In-Q-Tel is like a CVC which represents the US Intelligence Community and comprises more than a dozen agencies, offices, and bureaus. In-Q-Tel began in 1999 as the investment arm of the Central Intelligence Agency and grew to represent the Department of Homeland Security, the National Security Agency, and other US intelligence groups. In-Q-Tel investment partners tend to have earned their stripes in the traditional VC-CVC world. In-Q-Tel investment partners scout for startups and investment opportunities based on declassified-but-private “Problem Sets” provided as guidance by the Intelligence Community.

Angel investors and private citizens who invest their personal capital in early-stage companies, are essential members of the startup ecosystem by providing early financial and strategic support to new companies. I do not explicitly delve into angel investment since much has been written about this investor group. For this same reason, I do not expound on “impact” angel investors who tend to have a strong strategic thesis in addition to financial objectives.

Each investor and investment group has its preferred stages of investment, which are commonly referred to as Pre-Seed, Seed, Series A, B, C, etc. Likewise, investors tend to prefer or avoid ‘leading a round’ of syndicated, multi-investor fundraising for a startup. For example, In-Q-Tel, with its typical investment check size ranging from $250,000 to $500,000 (which is considered a small investment size) is not typically a significant or leading monetary investor except for Seed round venture financing. An investor who writes a relatively small check is not to be interpreted as a diminutive player in the investment round, however. For example, In-Q-Tel’s technical due diligence is particularly respected among the venture investment community.

Investors and the Defense Industry

Defense industry investors tend to be reserved when it comes to promoting their dual-use venture portfolios.

The defense industry overall is naturally “quiet”. Several factors contributing to the austere atmosphere include strict, institutionalized confidentiality procedures, respect for authority, and explicit hierarchical chain-of-command. There is a practicality to avoiding undue visibility, as it usually means exposure to fewer questions to answer, and thus less risk of overstepping confidentiality requirements. Such lack of information and data transparency, however, may also alienate startups that might consider taking part in the defense and defense-adjacent markets.

Furthermore, some groups are against investment in defense applications on principle. For example, in 2018, Googlers organized a successful withdrawal of Google’s bid for the lucrative US Department of Defense’s ten billion dollar Joint Enterprise Defense Infrastructure (JEDI) cloud computing contract. Despite aforementioned protests, Google applied for and was awarded the DoD’s Anthos multi-cloud management contract. Other tech titans, including Microsoft and Amazon, have more favorable relationships with government agencies and support defense collaborations. Furthermore, Silicon Valley traces its roots to technical defense work.

The observations above contextualize the operating environment for a DuV entrepreneur seeking venture capital. The defense-oriented investment community contains several distinct motivations. These are important for entrepreneurs to understand in order to seek financial support for their tough tech ventures.

In the next piece, I discuss complexity within the defense industry. █

This post is part of the Who’s Your Ally series, by Jonathan B. Miller, an MIT Innovation Initiative research affiliate.

Copyright © 2020 Jonathan B. Miller <jmill@alum.mit.edu>